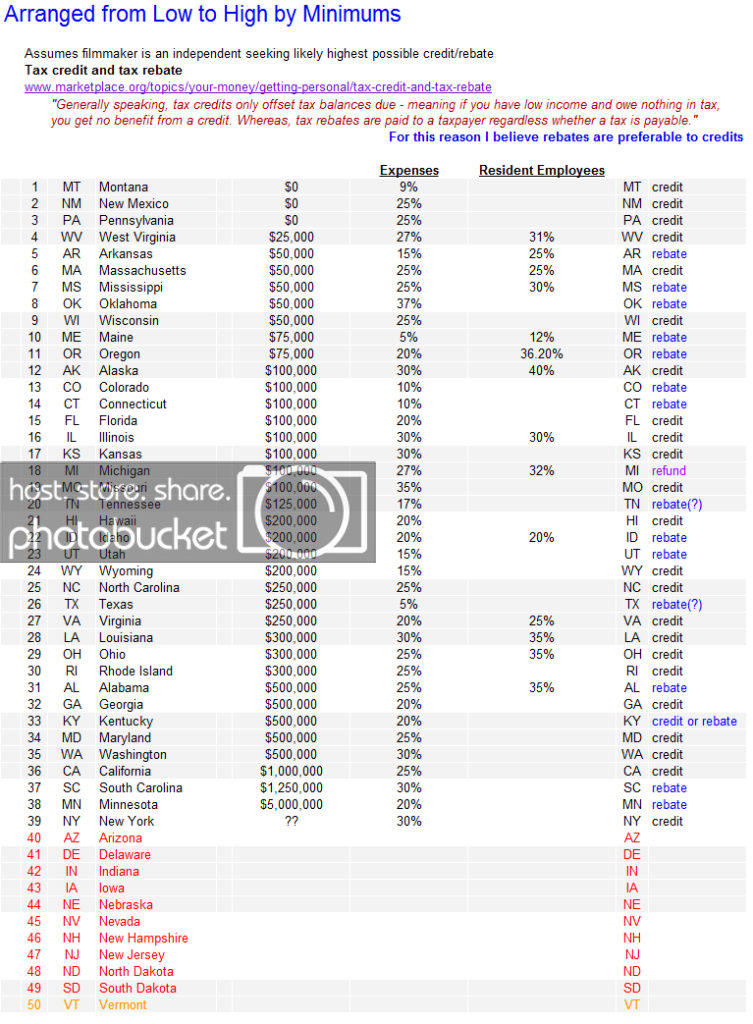

https://docs.google.com/spreadsheet/ccc?key=0AsBznn8D13zOdHVZN2NOQnV4em5nbTZZU2M3eXg2RGc#gid=0

Some states have "Hoe-lee sh!t!!" no hassle minimums and criteria, like Massachusetts, Montana, New Mexico, and Pennsylvania

And then there are some states that just want to make the whole process a PITA.

And then there are several that just don't care.

And then a few that kinda just make sense.

KRAYYYY-ZEEEEE!

I've yet to get a full handle on the difference between a credit and a rebate - but I'm working on it.

Howziss...?:

http://www.marketplace.org/topics/your-money/getting-personal/tax-credit-and-tax-rebate

"Generally speaking, tax credits only offset tax balances due - meaning if you have low income and owe nothing in tax, you get no benefit from a credit.

Whereas, tax rebates are paid to a taxpayer regardless whether a tax is payable.

There is an exception to this rule - the earned income tax credit which operates like a rebate.""

That looks like rebates will be much better, since tax credits are income dependent while rebates are expense dependent.

Some states have "Hoe-lee sh!t!!" no hassle minimums and criteria, like Massachusetts, Montana, New Mexico, and Pennsylvania

And then there are some states that just want to make the whole process a PITA.

And then there are several that just don't care.

And then a few that kinda just make sense.

KRAYYYY-ZEEEEE!

I've yet to get a full handle on the difference between a credit and a rebate - but I'm working on it.

Howziss...?:

http://www.marketplace.org/topics/your-money/getting-personal/tax-credit-and-tax-rebate

"Generally speaking, tax credits only offset tax balances due - meaning if you have low income and owe nothing in tax, you get no benefit from a credit.

Whereas, tax rebates are paid to a taxpayer regardless whether a tax is payable.

There is an exception to this rule - the earned income tax credit which operates like a rebate.""

That looks like rebates will be much better, since tax credits are income dependent while rebates are expense dependent.

Last edited: