see your cpa.

https://vimeo.com/22031702

No, they are not the same, though a special tax deduction IS a type of tax incentive..

A tax deduction lets you subtract some amount from your taxable income.

Say you earned $100,000 and you normally pay 25% tax. The amount of tax you pay is easy, 25% of $100,000 or $25,000. Now pretend that you bought a new camera for $1000. Depending on how you do it, you "deduct" some PORTION (but not all) of the cost of the new camera from your income. Say the tax deduction for new cameras was 10% . 10% of $1000 is $100. Subtract that deduction from your income. $100,000. Your new "adjusted income" is $99,000. Now you pay 25% tax on $99,000 rather than $100,000. You new tax would be 25% of $99,000 or $24,750. That's a grand savings of $250!

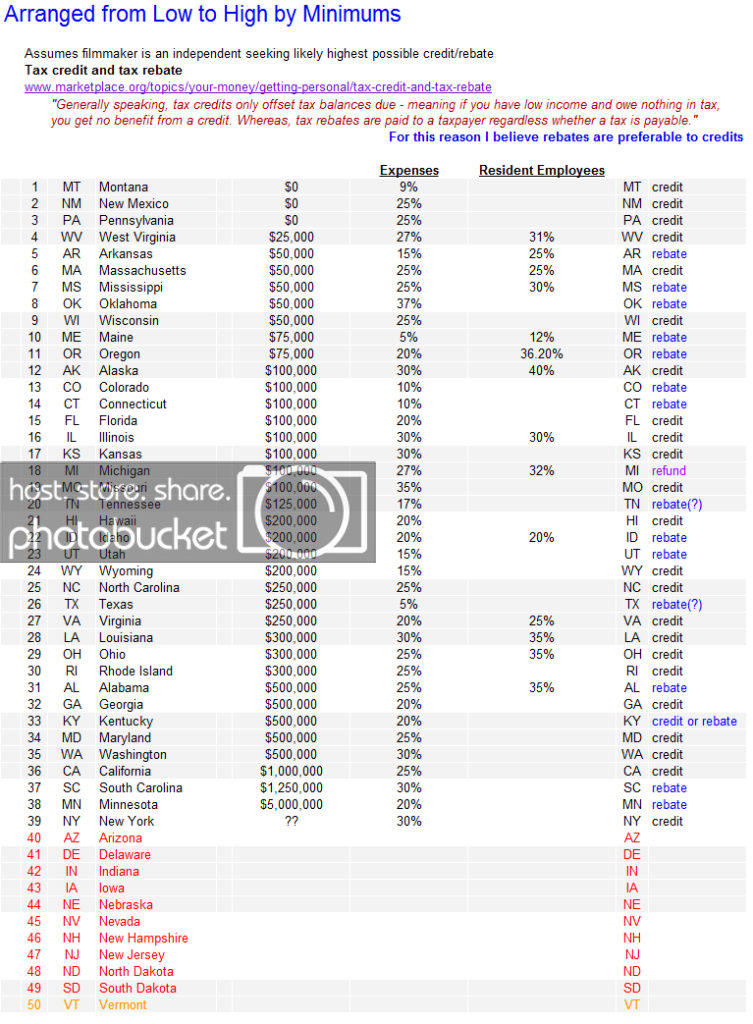

Tax Incentives are government offered "tax breaks" such as a lower "local biz tax rates" or even a tax "credits" for certain purchases, some are just straight up cash payments. For example in Oregon a big production gets a check for %20 of all the production related purchases made in Oregon! That's some incentive!

✅ Technical and creative solutions for your film.

✅ Technical and creative solutions for your film.