With the November 3 launch of its “Basic with Ads” tier in the U.S., Netflix will officially have four different pricing tiers. That feels like one too many — even if that service is Netflix.

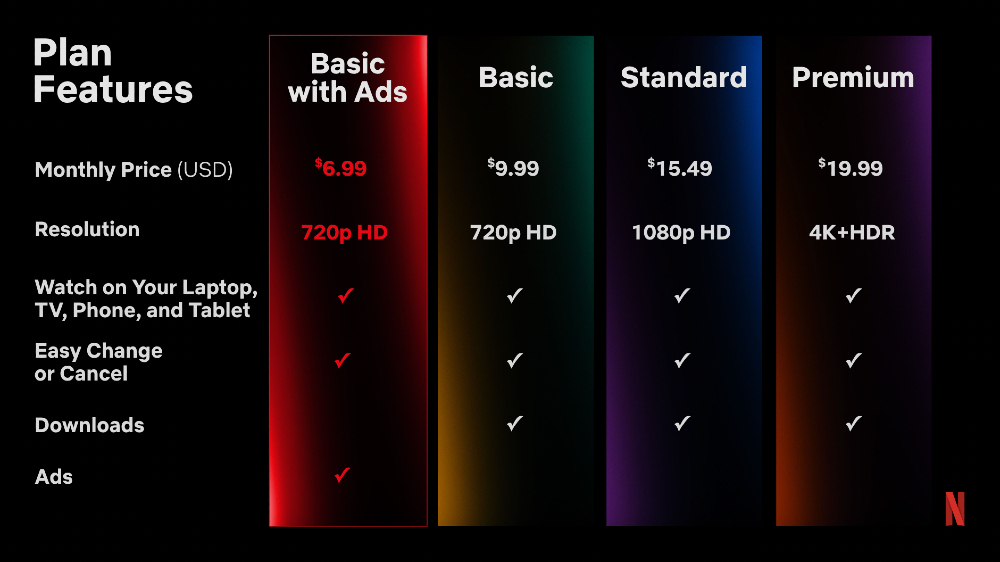

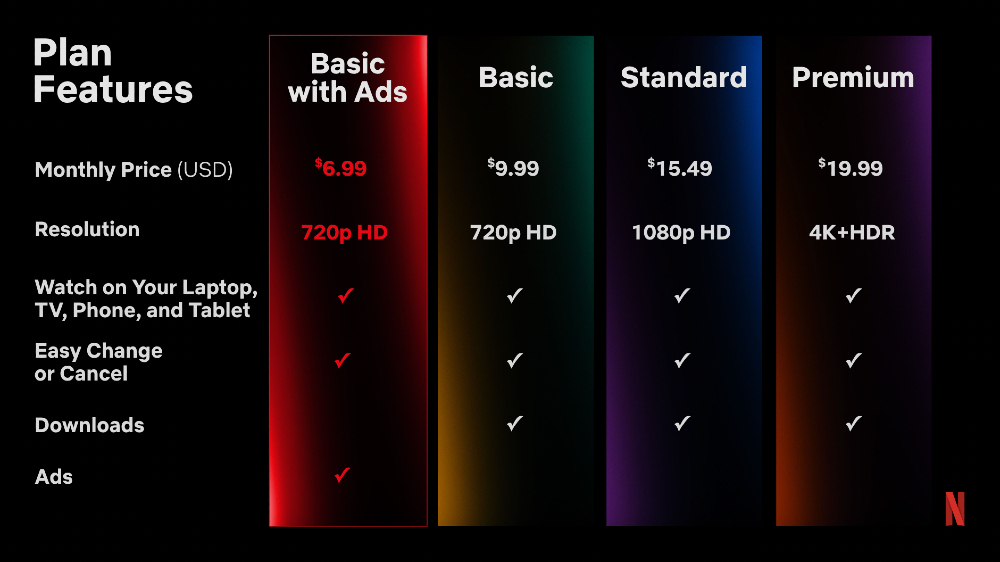

“Basic with Ads” will cost $6.99 per month at launch, $3 (or about 30 percent) less than the company’s existing “Basic” plan, which is ad-free. Simultaneously, the existing “Basic” plan without ads will be upgraded from 480p resolution to 720p, bringing it into high-definition territory; “Basic with Ads,” which will include 4-5 minutes of commercials per hour, will also be in 720p.

Netflix’s “Standard” plan, the 1080p one you probably have, costs $15.49 per month; it allows for simultaneously streaming and/or downloading on two devices. Its “Premium” tier is $19.99; for that price one can watch programming in 4K resolution as well as download to four devices instead of two. A Basic subscriber can stream and download to a single device.

“Basic with Ads” customers will not be able to download programming — not at first, at least. That’s “mostly due to some technical complexities and how we would show ads within downloads,” Netflix COO and Chief Product Officer Greg Peters said during a Thursday conference call with media, adding that “We didn’t want to hold up the general release to implement” it.

Peters said “Basic with Ads” will “complement” the existing three options. Pricing on the existing plans will not change — for now. Five to 10 percent of Netflix’s library will not be available on the ad-free tier at launch time, Peters said; they’re still working on updating the old licensing agreements on those films and series.

A common concern among media analysts is how many ad-free subscribers “Basic with Ads” may cannibalize — but will it also cannibalize “Basic” itself? Think about it: Is it worth saving $3 per month to sit through ads, give up the ability to download, and lose access to some of the archives? The current distinctions between those two tiers, in both price and features, just doesn’t feel aligned with the jumps to the streamer’s higher-level tiers.

With consolidation all the rage in media, maybe Netflix will apply that concept to the structure of its plans. If they don’t rightsize (another media buzzword these days, unfortunately) the number of offerings, a price adjustment may come sooner than later. See a slide from the Netflix presentation below.

Netflix’s Ads Plan Features

Courtesy of Netflix

Impressively, “Basic with Ads” is launching more than a month ahead of the ad-supported Disney+ tier (on December . That’s quite an accomplishment considering Disney+ announced its ad tier months ahead of Netflix, and The Walt Disney Company has been selling ads for Hulu for years now. Well done, Microsoft.

. That’s quite an accomplishment considering Disney+ announced its ad tier months ahead of Netflix, and The Walt Disney Company has been selling ads for Hulu for years now. Well done, Microsoft.

So “Basic with Ads” will not just beat the Disney+ ad tier to market, it also undercut the competition by a dollar; Disney+ with ads will cost $7.99 a month. That’s the old ad-free price; ad-free Disney+ will increase to $10.99 monthly. So, the same $3 difference — just shifted by a buck. HBO Max with ads, by the way, costs $9.99 per month — the same as Netflix’s ad-free “Basic” plan.

When asked about pricing on the conference call, Peters said the decision was “not really” made to get Disney’s goat. “We’re not heavily anchoring off the competitive set,” he said. “Really, our calculus is much more around, ‘What is the entertainment value that we are delivering to members at a given plan time at a given feature set in a given country?’”

Peters said he expects average revenue per user (ARPU) from the “Basic with Ads” subscribers to be “neutral to positive” vs. those on the ad-free plan. His colleague, Snap alum and Netflix’s new president of worldwide advertising Jeremi Gorman, said they have hundreds of advertisers lined up for launch, and are “nearly sold out” of inventory. Yes, even with sky-high CPMs.

Evan Peters as Jeffrey Dahmer in “Dahmer. Monster: The Jeffrey Dahmer Story.”

SER BAFFO/NETFLIX

So far, advertisers are buying in to ad-supported Netflix; so are investors. Shares in NFLX rose $25 apiece from Thursday morning to Friday morning. Wedbush analysts wrote on Friday that “Netflix is appropriately responding to macroeconomic headwinds by lowering costs to accommodate slower revenue growth.” Their price target is $280 per share; NFLX stock closed Friday at $230.

Wedbush believes 15-25 percent (or 11-18 million) of Netflix users in the U.S. and Canada will downgrade their subscriptions to “Basic with Ads.” They anticipate that as many as 5 million new or returning customers will sign up. Analysts are also keen on Netflix’s plan to combat password sharing.

Not everyone on Wall Street is diving in head first. Wells Fargo (price target: $300) called the “Basic with Ads” speed-to-market “impressive,” but cautioned: “We think it may take a little while to scale impressions, build audiences, and ultimately deliver a platform that can take in major advertising dollars that satisfy frequency and reach requirements.”

Moffett Nathanson referred to the AVOD details released on Thursday “an incremental positive” — but their Netflix revenue and earnings estimates remain below the street’s consensus.

Netflix reports its third-quarter earnings results on Tuesday afternoon.

“Basic with Ads” will cost $6.99 per month at launch, $3 (or about 30 percent) less than the company’s existing “Basic” plan, which is ad-free. Simultaneously, the existing “Basic” plan without ads will be upgraded from 480p resolution to 720p, bringing it into high-definition territory; “Basic with Ads,” which will include 4-5 minutes of commercials per hour, will also be in 720p.

Netflix’s “Standard” plan, the 1080p one you probably have, costs $15.49 per month; it allows for simultaneously streaming and/or downloading on two devices. Its “Premium” tier is $19.99; for that price one can watch programming in 4K resolution as well as download to four devices instead of two. A Basic subscriber can stream and download to a single device.

“Basic with Ads” customers will not be able to download programming — not at first, at least. That’s “mostly due to some technical complexities and how we would show ads within downloads,” Netflix COO and Chief Product Officer Greg Peters said during a Thursday conference call with media, adding that “We didn’t want to hold up the general release to implement” it.

Peters said “Basic with Ads” will “complement” the existing three options. Pricing on the existing plans will not change — for now. Five to 10 percent of Netflix’s library will not be available on the ad-free tier at launch time, Peters said; they’re still working on updating the old licensing agreements on those films and series.

A common concern among media analysts is how many ad-free subscribers “Basic with Ads” may cannibalize — but will it also cannibalize “Basic” itself? Think about it: Is it worth saving $3 per month to sit through ads, give up the ability to download, and lose access to some of the archives? The current distinctions between those two tiers, in both price and features, just doesn’t feel aligned with the jumps to the streamer’s higher-level tiers.

With consolidation all the rage in media, maybe Netflix will apply that concept to the structure of its plans. If they don’t rightsize (another media buzzword these days, unfortunately) the number of offerings, a price adjustment may come sooner than later. See a slide from the Netflix presentation below.

Netflix’s Ads Plan Features

Courtesy of Netflix

Impressively, “Basic with Ads” is launching more than a month ahead of the ad-supported Disney+ tier (on December

. That’s quite an accomplishment considering Disney+ announced its ad tier months ahead of Netflix, and The Walt Disney Company has been selling ads for Hulu for years now. Well done, Microsoft.

. That’s quite an accomplishment considering Disney+ announced its ad tier months ahead of Netflix, and The Walt Disney Company has been selling ads for Hulu for years now. Well done, Microsoft.So “Basic with Ads” will not just beat the Disney+ ad tier to market, it also undercut the competition by a dollar; Disney+ with ads will cost $7.99 a month. That’s the old ad-free price; ad-free Disney+ will increase to $10.99 monthly. So, the same $3 difference — just shifted by a buck. HBO Max with ads, by the way, costs $9.99 per month — the same as Netflix’s ad-free “Basic” plan.

When asked about pricing on the conference call, Peters said the decision was “not really” made to get Disney’s goat. “We’re not heavily anchoring off the competitive set,” he said. “Really, our calculus is much more around, ‘What is the entertainment value that we are delivering to members at a given plan time at a given feature set in a given country?’”

Peters said he expects average revenue per user (ARPU) from the “Basic with Ads” subscribers to be “neutral to positive” vs. those on the ad-free plan. His colleague, Snap alum and Netflix’s new president of worldwide advertising Jeremi Gorman, said they have hundreds of advertisers lined up for launch, and are “nearly sold out” of inventory. Yes, even with sky-high CPMs.

Evan Peters as Jeffrey Dahmer in “Dahmer. Monster: The Jeffrey Dahmer Story.”

SER BAFFO/NETFLIX

So far, advertisers are buying in to ad-supported Netflix; so are investors. Shares in NFLX rose $25 apiece from Thursday morning to Friday morning. Wedbush analysts wrote on Friday that “Netflix is appropriately responding to macroeconomic headwinds by lowering costs to accommodate slower revenue growth.” Their price target is $280 per share; NFLX stock closed Friday at $230.

Wedbush believes 15-25 percent (or 11-18 million) of Netflix users in the U.S. and Canada will downgrade their subscriptions to “Basic with Ads.” They anticipate that as many as 5 million new or returning customers will sign up. Analysts are also keen on Netflix’s plan to combat password sharing.

Not everyone on Wall Street is diving in head first. Wells Fargo (price target: $300) called the “Basic with Ads” speed-to-market “impressive,” but cautioned: “We think it may take a little while to scale impressions, build audiences, and ultimately deliver a platform that can take in major advertising dollars that satisfy frequency and reach requirements.”

Moffett Nathanson referred to the AVOD details released on Thursday “an incremental positive” — but their Netflix revenue and earnings estimates remain below the street’s consensus.

Netflix reports its third-quarter earnings results on Tuesday afternoon.